indiana real estate tax lookup

LOCAL BANKS - First Financial Bank. For child support payments.

Law Enforcement Academy Indiana.

. Property Report Card. Search for your property. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

6-11-4-4 the State of Indiana now requires that an annual field visit of 25 of its parcels be completed. To transfer a deed discuss property ownership or other deed information. View Ownership Information including Property Deductions and Transfer History.

Forms of payment accepted. Enter your last name first initial. When you have selected your property you can.

About Assessor and Property Tax Records in Indiana. Find All The Record Information You Need Here. Find Indiana residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more.

Many County Assessor Offices provide an online searchable database whereby searches can be performed by parcel. Please contact the Indiana Department of Revenue at 317 232-1497. MAIL PAYMENT - Montgomery County Treasurer1580 Constitution Row Crawfordsville IN 47933.

Our property records tool can return a variety of information about your property that affect your property tax. When this occurs the tax due date is the next business day. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents.

Indiana Career Connect. The official website of the DeKalb County Indiana. 124 Main rather than 124 Main Street or Doe rather than John Doe.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. You should see a picture of the property and to the. Land and land improvements are considered real property while mobile property is classified as personal property.

Tips for Your Job Search. Unsure Of The Value Of Your Property. View and print Assessed Values including Property Record Cards.

Free Indiana Property Tax Records Search. Search multiple properties on the same street. Since the information displayed appears exactly as it.

Find the first property and click on it. Cash Cashier Checks Personal Checks and Money Orders. Ad Enter Any Address Receive a Comprehensive Property Report.

CreditDebit Cards are now accepted in the Treasurers Office 25 fee by phone 1-877-690-3729 25 fee and through the Internet at wwwsteubeninus or FORTE. Property Report Card Loading. Printview your Property Record Card.

View and print Tax Statements and Comparison Reports. A Indiana Property Records Search locates real estate documents related to property in IN. Dog Tax - ALL dog owners are legally bound to pay 5 for each dog.

Thus allowing 100 of the counties parcels be re-evaluated every 4 years. Choose from the options below. You can obtain your prior year tax information on the GIS website.

Property Tax Due Dates are May 10 2022 and November 10 2022. May 13SOUTHERN INDIANA Southern Indiana residents can expect increases in their property tax assessments next year as long as Indiana housing marketing. For best search results enter a partial street name and partial owner name ie.

Number is located on the left corner of your tax bill. To redeem a property that was sold on tax sale or commissioners sale. Printview a tax bill or pay a tax bill.

100 S Main Street Auburn Indiana 46706 260-333-0701. You can search the propertyproperties by. Search by address Search by parcel number.

Use our free Indiana property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Enter the number and a few letters of the remaining address if the property is not found shorten up on the criteria you entered. Lake County Property Tax Payments will be accepted at this website until May 10 2022 at 1130.

State Excise Police Indiana. Please direct all questions and form requests to the above agency. By selecting Beacon Online Mapping taxpayers can view real property personal property and mobile home property tax information real property record cards maps and other pertinent information related to the property.

Make and view Tax Payments get current Balance Due. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. ONLINE - Click link below - Choose Property Tax Dog Tax Tax Payments.

Available information includes property. Property taxes are due in two 2 installments. Homeland Security Department of.

Taxpayers with questions about their tax bills may contact the Kosciusko County Treasurers Office at 1-574-372-2370. It may not reflect the most current information pertaining to the property of interest. PAY by PHONE - 1-855-276-8051.

Property Tax Installment Due Dates are May 10 and November 10. For property tax exemptions and deductions. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

Criminal Justice Institute. Jobs Marketplace. Use this application to.

For assessment values and appeals. Printview the County Assessors Form 11 when available. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy.

Court House 101 S Main Street New Castle IN 47362 Justice Center 1215 Race Street New Castle IN 47362 Henry County Office Building 1201 Race Street. May 12 2022 901 PM 2 min read. WTHGIS allows taxpayers to view property record cards aerial photographs tax amounts deductions and much more.

Corrections Indiana Department of. National Guard Indiana. See Results in Minutes.

If those dates fall on a weekend or holiday payments are due on the next business day. Property tax statements are mailed to Johnson County taxpayers once a year in April. The information provided in these databases is public record and available through public information requests.

Property Reports and Tax Payments. Real and personal property tax records are kept by the County Assessor in each Indiana County. The due dates are May 10th and November 10th unless these dates fall on a weekend or holiday.

Main Street Crown Point IN 46307 Phone.

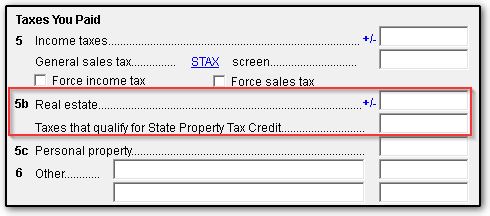

Deducting Property Taxes H R Block

Property Records Information Hamilton County In

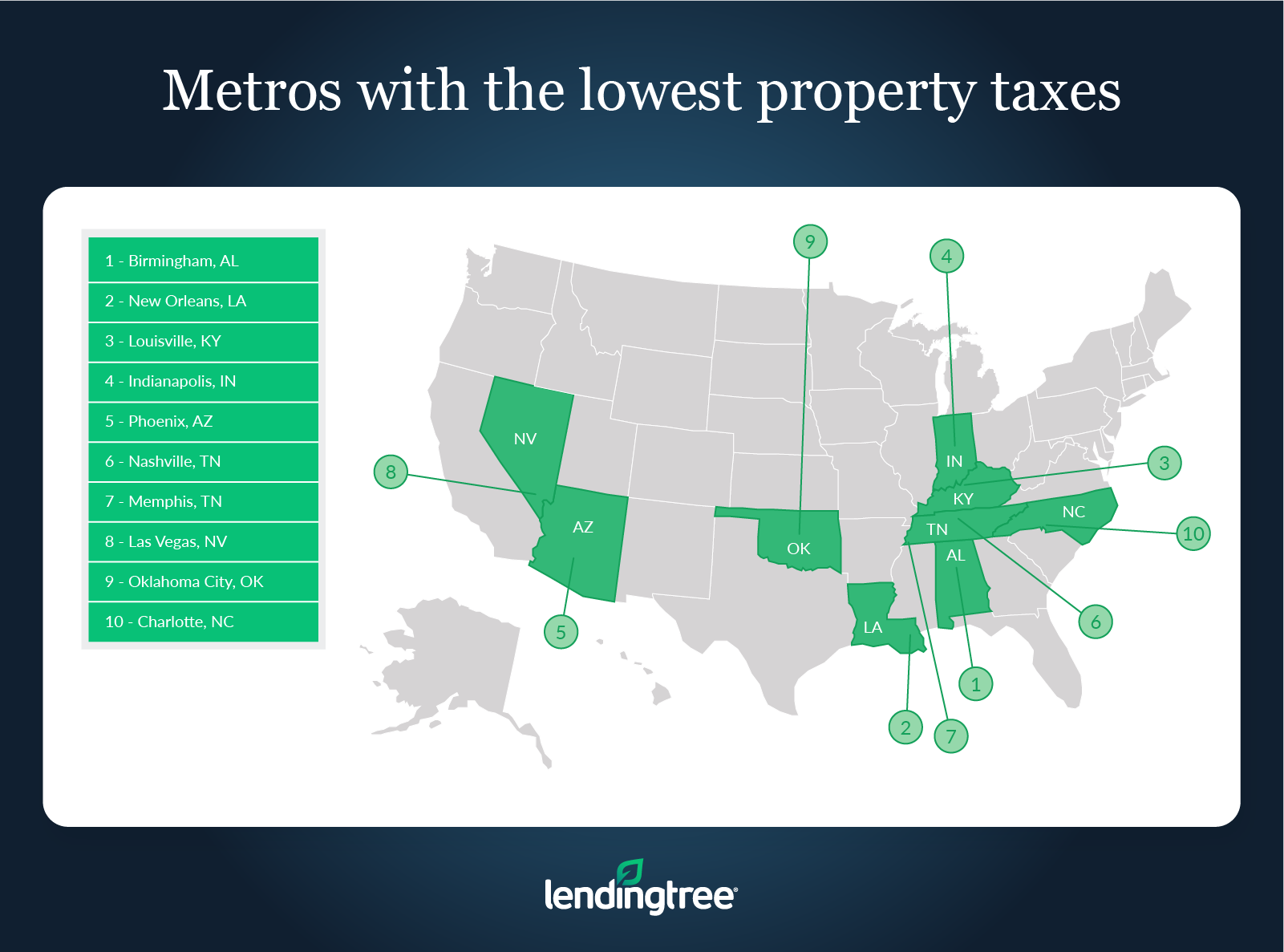

Where People Pay Lowest Highest Property Taxes Lendingtree

The Ultimate Guide To Indiana Real Estate Taxes

Indiana Property Tax Calculator Smartasset

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Treasurer S Office Tipton County In

Assessor S Office Sullivan County In

Treasurer Johnson County Indiana

About The Local Tax Finance Dashboard Gateway

Pennsylvania Property Tax H R Block

Property Tax Appeal Tips To Reduce Your Property Tax Bill