am i taxed on stock dividends

This is in the basic rate tax band so you would pay. Visit our Dividend Calendar.

Dividend Tax Rate For 2022 Smartasset

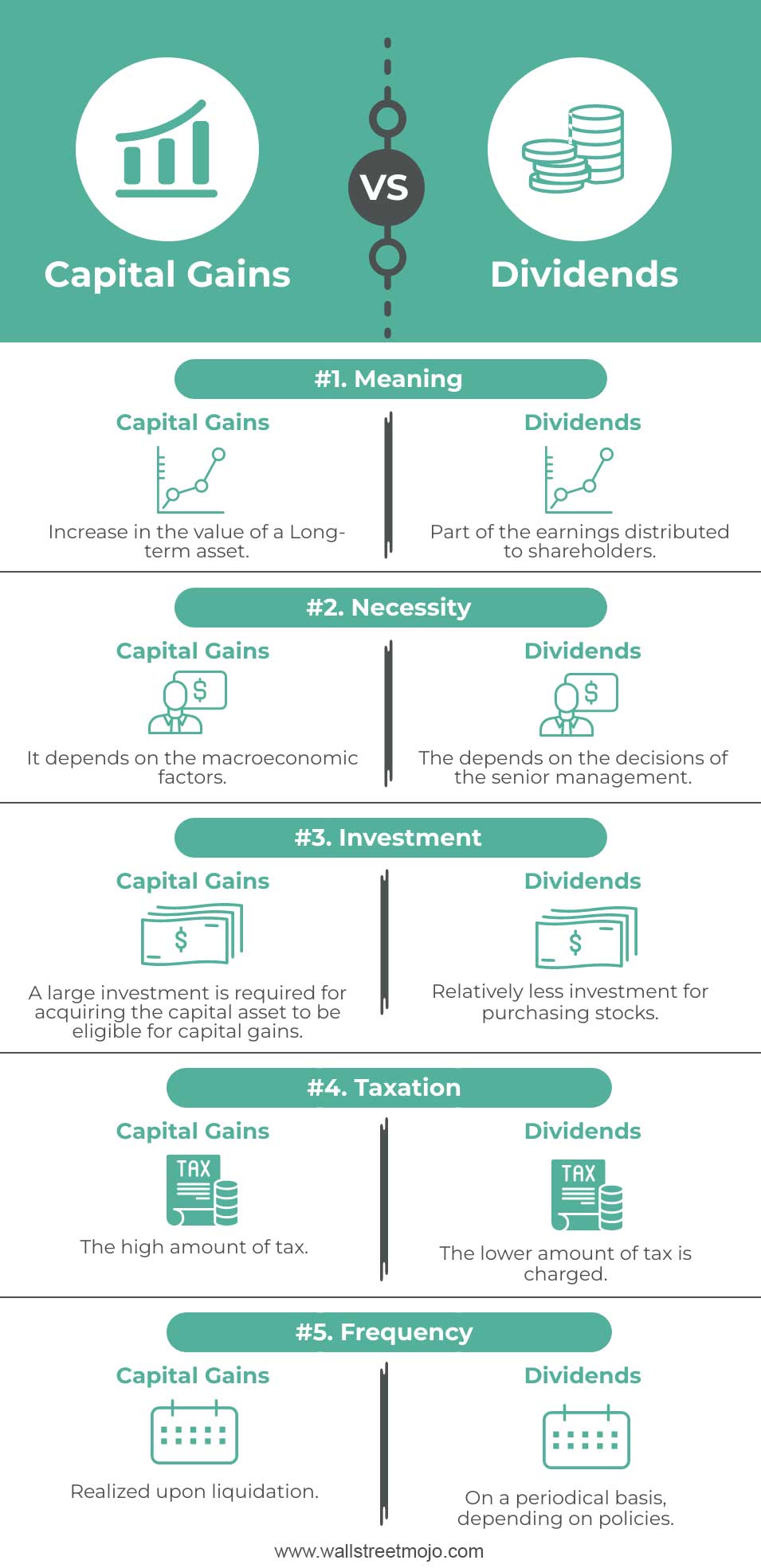

You pay tax on those at your capital gains rate.

. Additionally under 2 of TDS 325 billion debt is due before. 2 days agoTDS spends 70 million on preferred dividends which are also adequately covered by the companys EBITDA. Ordinary dividends are taxed at regular income tax rates rather than at capital gains rates.

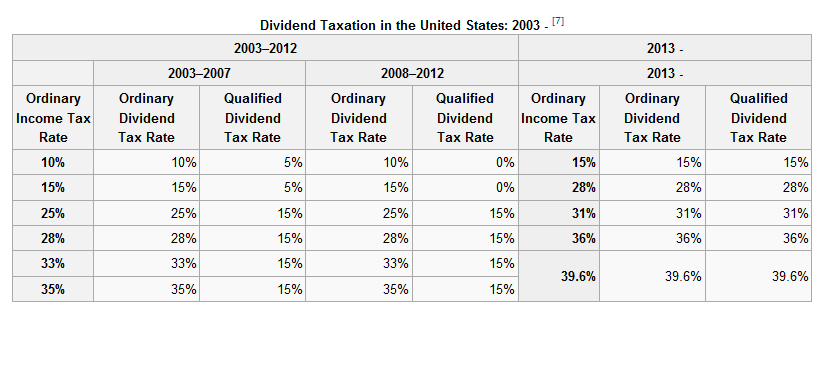

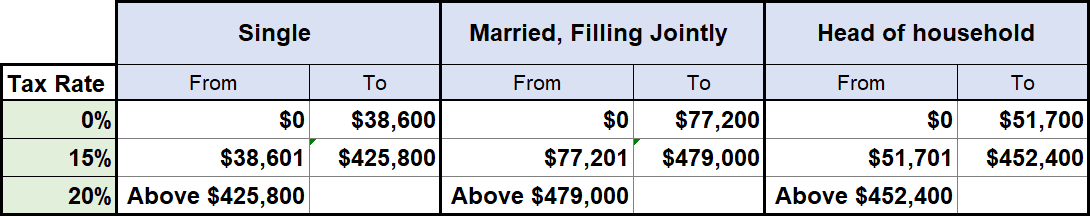

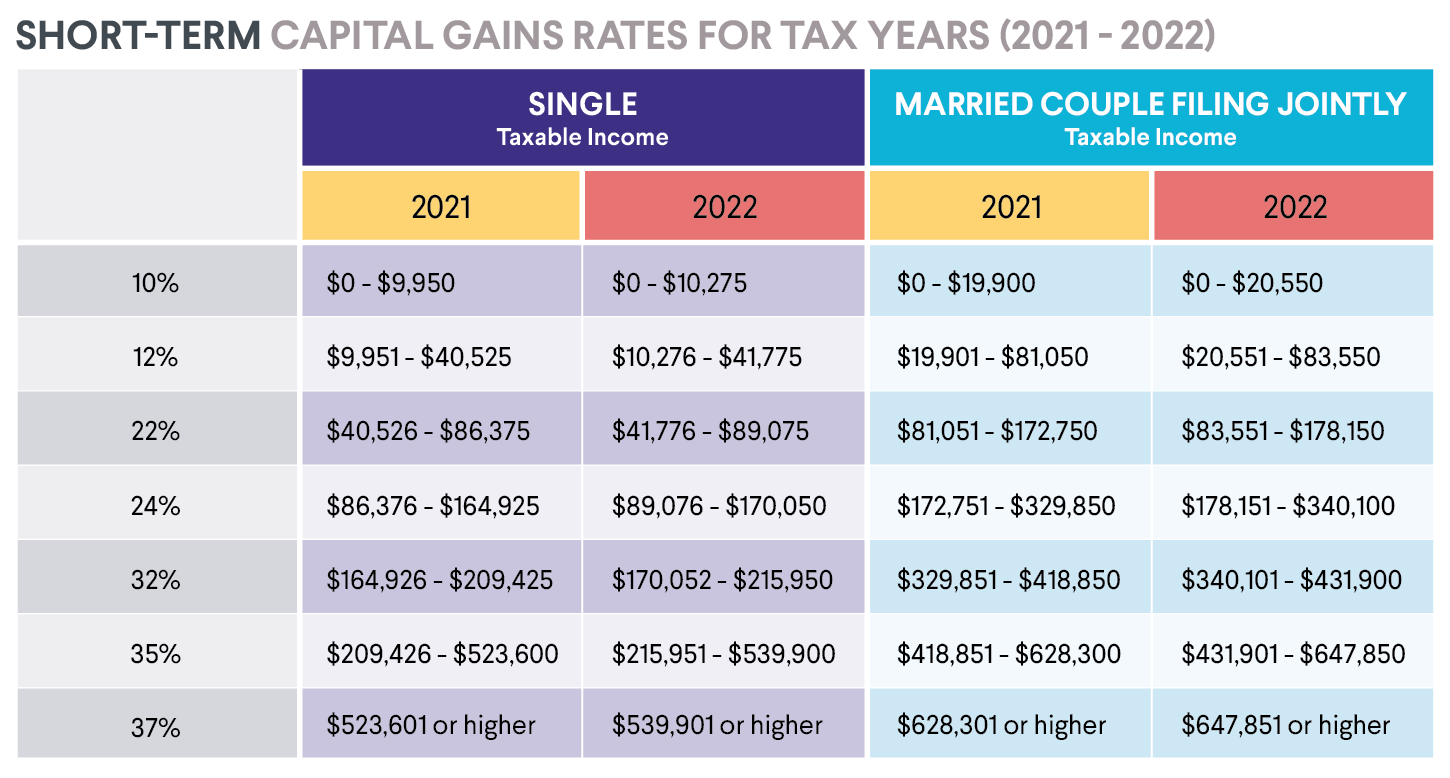

The primary drawback of these dividends is that the IRS taxes them at higher rates than qualified dividends. Yes the IRS considers dividends to be income so you usually need to pay taxes on them. The top 20 bracket on qualified dividends is only shouldered by the extremely well-off.

This is usually lower than the rate for nonqualified dividends. When a shareholder receives a dividend they must include it in their tax return. Qualified dividends however are taxed at lower capital gains rates with a.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. 2 hours agoThe income which accrues to the HUF on the gift made by the member is subject to clubbing provisions and such income will continue to be clubbed and taxed in the hands of the. The Dividend History page provides a single page to review all of the aggregated Dividend payment information.

20 tax on 17000 of wages. For the tax year 2022 the IRS taxes nonqualified dividends at the. No tax on 2000 of dividends because of the dividend allowance.

This should be plenty to. Usually thats just 15 percent though some taxpayers. However they are often confused on how PIK dividends are taxed.

The tax rules that apply to PIK dividends depend on whether the PIK dividend is paid on common stock or. Some dividends known as qualified dividends get special tax treatment. Dividends are federal and provincial taxes.

Even if you reinvest all of your dividends directly back into. How Are Dividends Taxed. The tax component of qualified dividends is taxed at 150198.

20 minutes agoIt also puts the company on track to continue its 22-year dividend growth streak by raising its 44-yielding dividend at its target annual rate of 5-9. Specifically you must record 488851 or more in taxable income as of the 2019 tax. AM Dividend History.

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Tax Implications Of A Dividend H R Block

Double Taxation Of Corporate Income In The United States And The Oecd

Taxation Of Dividend Income And Capital Gains

Dividend Tax Rate 2022 Rates Calculation Seeking Alpha

State Taxes On Capital Gains Center On Budget And Policy Priorities

Cost Of Preferred Stock Kp Formula And Calculation

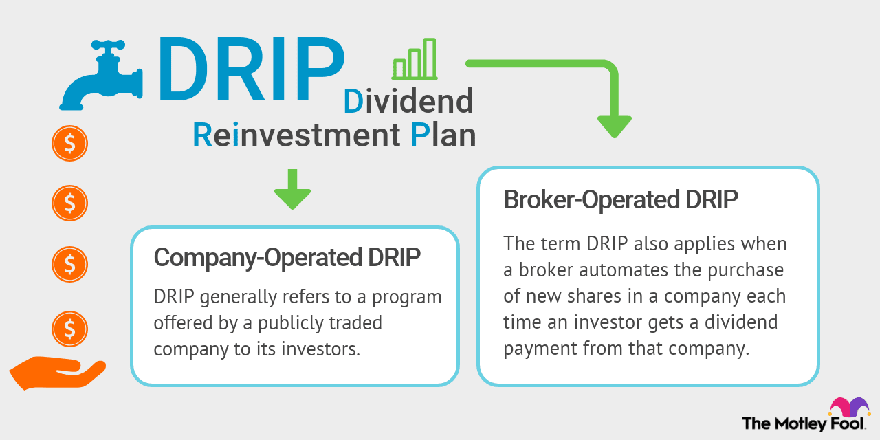

Dividend Reinvestment Should I Do It The Motley Fool

How Are Dividends Taxed Dividendinvestor Com

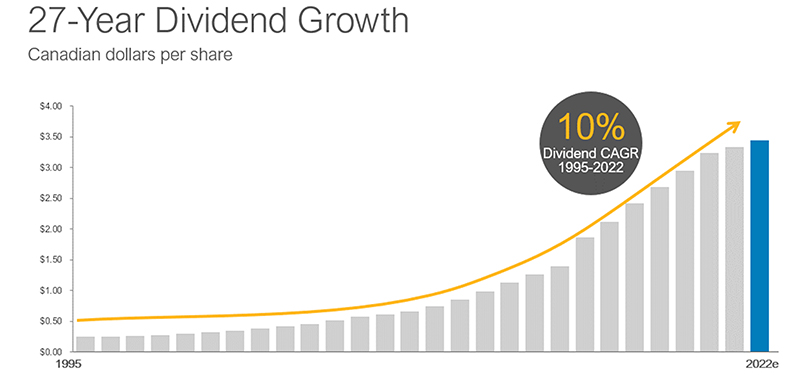

Dividends And Common Shares Enbridge Inc

What To Know About Paying Taxes On Stocks Sofi

Capital Gains Vs Dividends Top 5 Differences Infographics

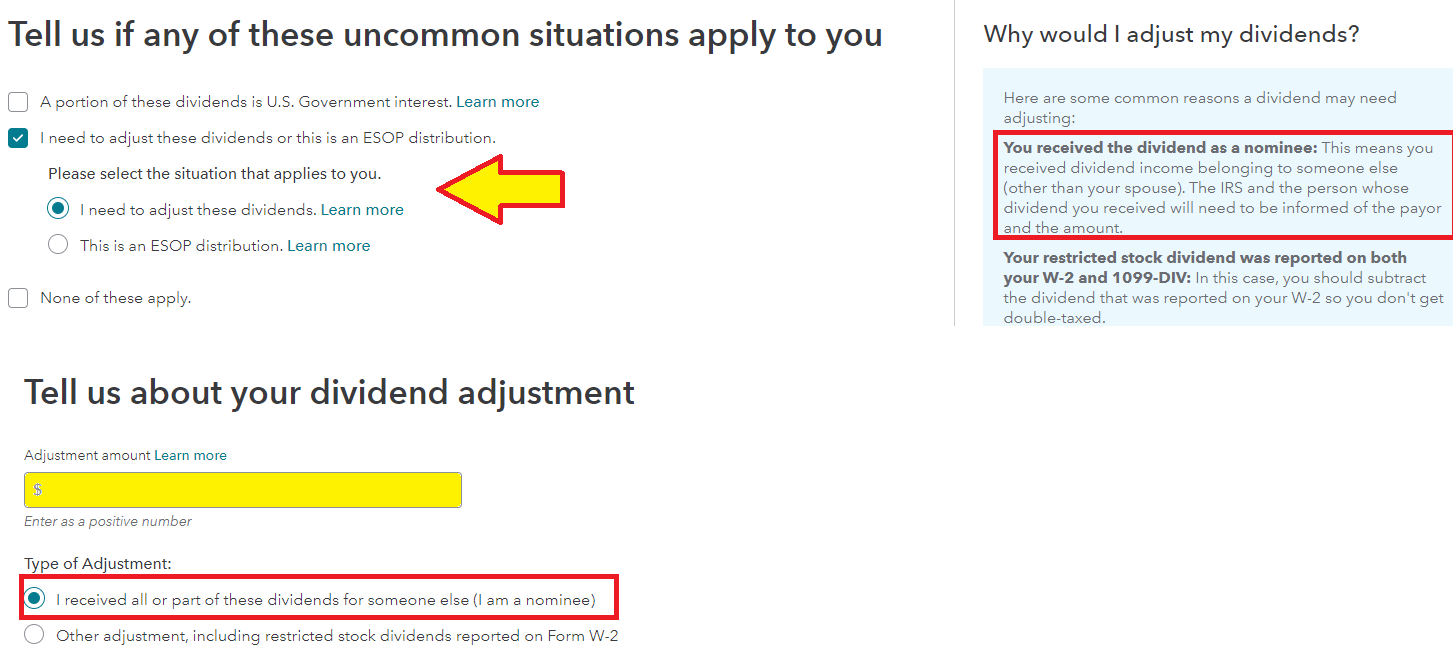

How Do I Report Dividends And Interest On Joint Accounts That All Use His Ssn As The Tax Id If We File Separate Tax Returns

How To Report Stocks And Investments On Your Tax Return Taxact

Understanding The Tax Implications Of Stock Trading Ally

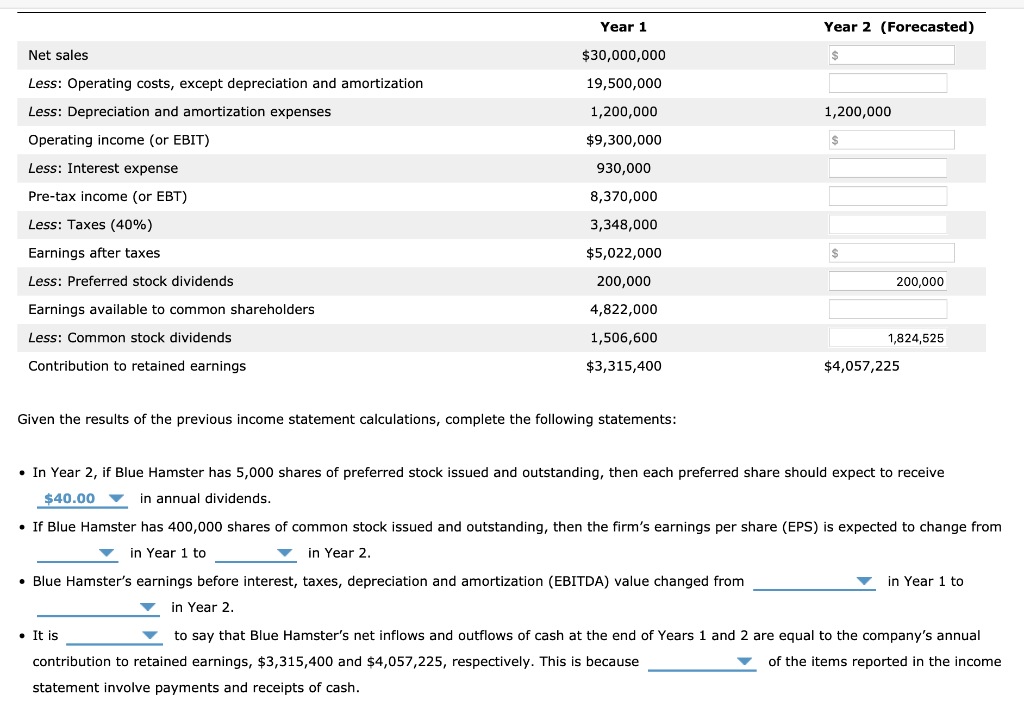

Year 2 Forecasted Net Sales Less Operating Costs Chegg Com